south dakota excise tax license

For help please call the Special Taxes Division at 605-773-5911. Types of Alcohol Licenses.

South Dakota Sales Tax Small Business Guide Truic

The lists are not all-inclusive.

. South Dakotas excise tax on gasoline is ranked 35 out of the 50 states. This includes repair or remodeling of existing real property or the construction of a new project. Contractor Excise License.

As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. 15 General Building Contractors 1521 Single-Family Housing Construction 11385938845 1767217055 9618721790 199934729192374436. Any person entering into a contract for construction services must have a South Dakota contractors excise tax license.

Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. There may be additional steps involved according to your type of business. If only your mailing address changes and the business location remains the same.

ATVs are exempt from the 4 excise tax. Deductions Excise Taxable South Dakota Contractors Excise Tax Reporting System Returns Filed. Please use the box provided on the return to correct your address or notify the South Dakota Business Tax Division.

Enter the Total Tax this is line 2 on your last non-zero South Dakota Tax Return. Find information on which cigarettes are allowed to be sold in South Dakota. C Construction MAJOR GROUP.

Sales Use and Contractors Excise Tax licenses. House trailer subject to 4 initial registration fee upon initial registration. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or contractors excise tax license.

If you owe tax and do not have a tax license please call 1-800-829-9188. This includes contractors who repair or remodel existing real. Contact the Governors Office of Economic Development to learn more.

ACH Debit or Credit Card for the Taxes Listed above. A license card will be issued once the license is approved. February 2022 Sales Use Taxable Excise Tax Due DIVISION.

Artisan Distiller Malt Beverage Manufacturer Carrier Liquor Common Carrier Microcidery Direct. However there are a few differences to consider. System maintenance will occure between 800am CST and 1200pm CST Sunday December 13 2015.

House trailer subject to 4 initial registration fee upon initial registration. Contractors excise tax is imposed on the gross receipts of all prime contractors engaged in. For starters South Dakota charges a 4 excise tax.

ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. Contractors providing construction services must obtain an excise tax number. 27 2022 South Dakota first implemented a sales tax in 1935 at two percent.

SOUTH DAKOTA CONTRACTORS EXCISE TAX REPORT Figures Compiled by The South Dakota Department of Revenue Pierre SD RETURNS FILED. Make Checks Payable to. Fixture to real property must have a South Dakota contractors excise tax license.

Like in Montana maybe RVers chose South Dakota RV registration for tax reasons. This application allows for the renewal of the following alcohol and lottery licenses. Who This Impacts Marketplace providers are required to remit sales tax on all sales it facilitates into South Dakota if the thresholds of 200 or more transactions into South Dakota or 100000 or more in sales to South Dakota.

Motor vehicle was on a licensed motor vehicle dealers inventory as of May 30 1985. Please call the Department at 1-800-829-9188 if you have not reported tax due. The check to the return.

JANUARY 2022 STATE-WIDE RECAP for Standard Industrial Classification SIC Industries 4 digits 2. Do NOT staple or paper clip. More information about the Contractors Excise License is available from the Department of.

Mailing address and office location. Sign up to file and pay your taxes electronically at the same time you. In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees.

Visit the South Dakota Department of Revenue for more information on Excise Taxation and to register. Motor vehicle was on a licensed motor vehicle dealers inventory as of May 30 1985. Enter the tax due line 23 from your last non-zero return.

Construction services include the construction building installation and remodeling of real property. The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

10 10 of the tax liability minimum 1000 penalty even if no tax is due is assessed if a return is not received within 30 days following the month the return is due. The RV registration fee is also very reasonable. That said this RV tax is still much lower than in most states.

Use tax license UT. The South Dakota Department of Revenue requires all contractors who enter into a contract for construction services to carry a South Dakota contractors excise tax license. Four years later the state instituted a two percent use tax.

CONTRACTORS EXCISE TAX RETURN License. The South Dakota gas tax is included in the pump price at all gas stations in South Dakota. 1 day agoSales Tax Rates 2022 South Dakota Legislative Session update by District 24 Senator Mary Duvall Feb.

A use tax license is required if your business purchases tangible personal property products transferred electronically or services on which South Dakota sales tax was not paid. If you dont have an EPath account and need to make a payment by. Sales and Contractors Excise Tax License Application.

Here you can find all the information necessary to start register and license a business in South Dakota. If you have any questions regarding the lottery please contact South Dakota Lottery at 1-605-773-5770. A wholesale license is required if your business sells all products to other businesses for resale.

Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Here you will find general information relative to starting growing operating or closing a business in South Dakota.

July 1 1993 excise tax law. Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located within special jurisdictions. The sales and use tax increased to three percent in 1965 and to four percent in 1969.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. South Dakota State Treasurer Please write your.

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

How To Register For A Sales Tax Permit In South Dakota Taxjar Blog

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Kansas Missouri State Line Kansas Missouri Missouri State Kansas

How To Register For A Sales Tax Permit In South Dakota Taxvalet

Publications Research Amp Commentary South Dakota House Considering Tax Increases For Select Businesses Heartland Institute

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

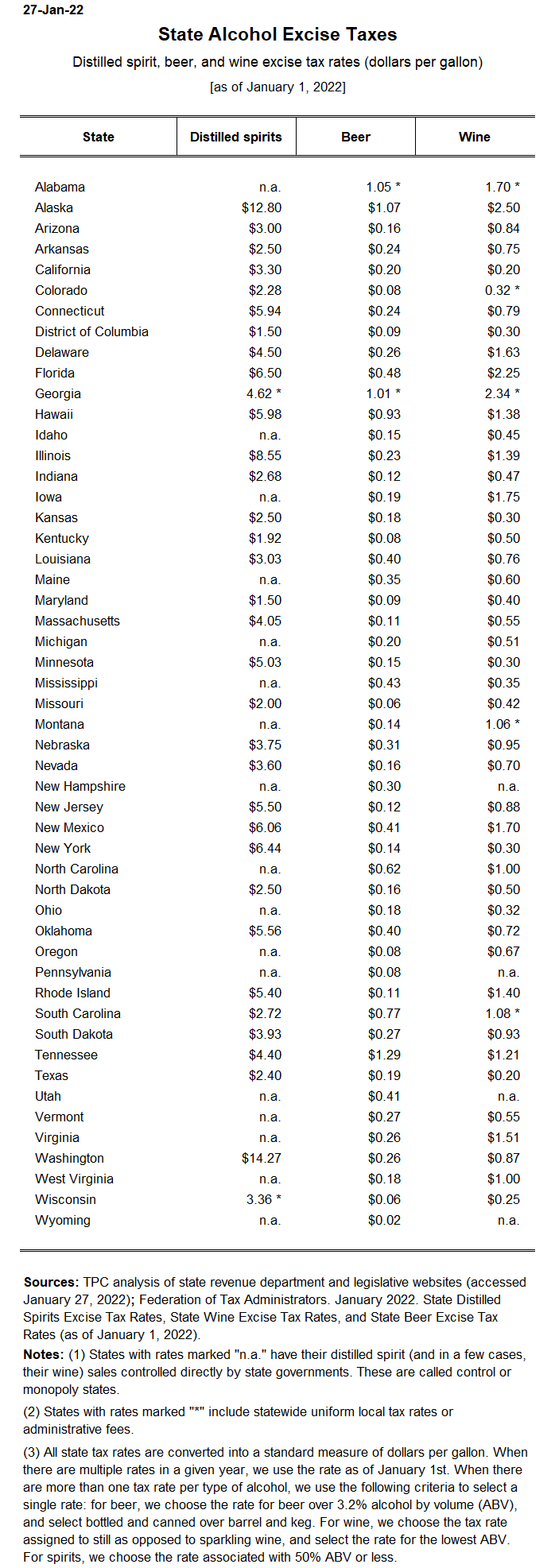

State Alcohol Excise Tax Rates Tax Policy Center

Contractor S Excise Tax South Dakota Department Of Revenue

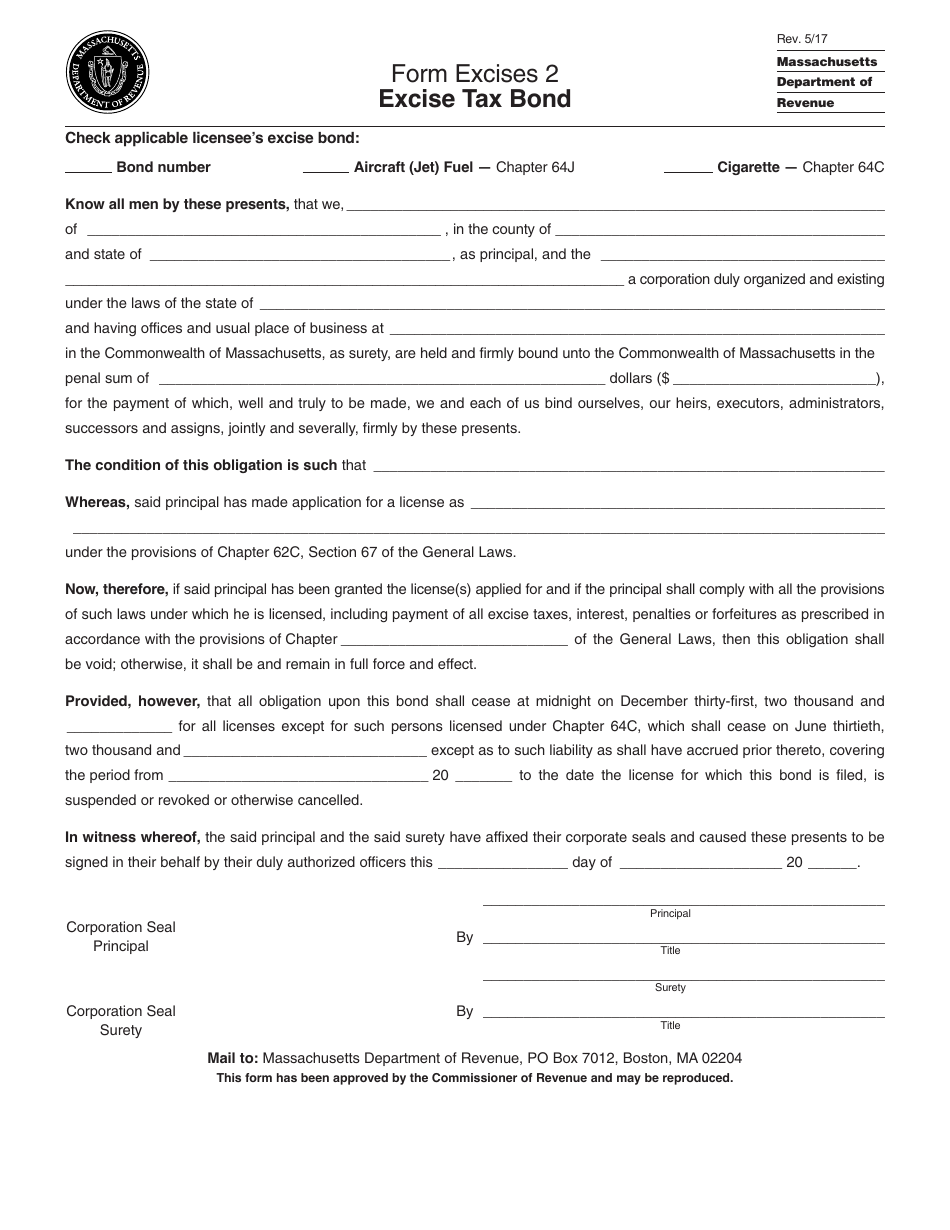

Form Excises2 Download Printable Pdf Or Fill Online Excise Tax Bond Massachusetts Templateroller

Sales Tax Guide For Online Courses

Contractor S Excise Tax South Dakota Department Of Revenue

Tax Knowledge Levels Of Shoppers On Select Food And Beverages Sold In Download Table

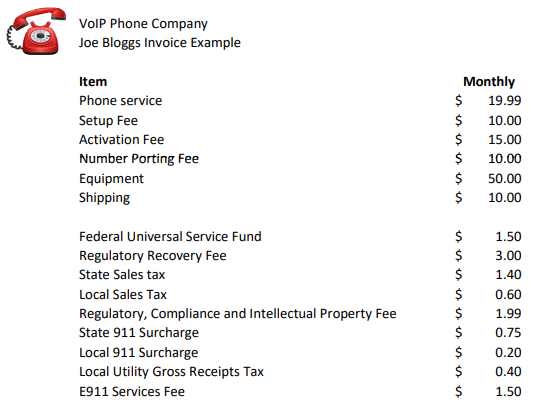

Voip Pricing Taxes And Regulatory Fees Explained

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

Excise Tax What Is It And How Does It Affect You Smartasset

Inmotion Hosting Tax Exemptions Taxes And Fees Inmotion Hosting Support Center